Page 13 - DCB 2019 Annual Report

P. 13

DIVER CERTIFICATION BOARD OF CANADA

2019 Annual Report

2018 A

2018 Annual Report nnual Report

STATEMENT OF FINANCIAL POSITION

2018 Annual Report

DECEMBER 31 2017 2016

Table of Contents able of Contents

T Table of Contents

Table of Contents

Who We Are

Who

3 3

ASSETS DIVER CERTIFICATION BOARD OF CANADA 3

Who We Are We Are

DIVER CERTIFICATION BOARD OF CANADA

Who We Are

International Recognition 3 3

3 3

CURRENT ASSETS STATEMENT OF FINANCIAL POSITION

NOTES TO FINANCIAL STATEMENTS

International Recognition

Cash Our Vision $ 279,833 $ 320,506 3 3

3 3

Our Vision Vision

Our

41,949

Accounts receivable 66,664 2018 3 3 2017

Our Vision

DECEMBER 31, 2019

Our Mission

DECEMBER 31

Our Mission Mission

3 3

Our

HST receivable 12,398 6,963

Our Mission

Prepaid expenses Our Board of Directors 11,320 28,460 3 3

Our

3 3

Our Board of Directors Board of Directors

Inventory 4. FINANCIAL INSTRUMENTS (Continued) 20,780 7,875 4 3

Our Board of Directors

ASSETS

What We Do

What We Do We Do

What

4 4

What We Do

Message from the Chairman

Message from the Chairman essage from the Chairman

5 5

M

Credit Risk $ 390,995 $ 405,753 5 4

CURRENT ASSETS

Message from the Chairman

M Cash

LIABILITIES Message from the CEO $ 217,067 6 6 $ 6 5 279,833

Message from the CEO essage from the CEO

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other

Accounts receivable

66,664

77,756

6

Message from the CEO

Auditor’s Report

Au

7 7

Auditor’s Report ditor’s Report

party by failing to discharge an obligation. Financial instruments that potentially subject the

HST receivable

CURRENT LIABILITIES 11,760 7 12,398

Auditor’s Report

company to concentrations of credit risk consist of cash and accounts receivable. The organization

Fi Prepaid expenses

Financial Statements

Accounts payable and accrued liabilities $ 10,058 $ 2,165 8 7 11,320

10,488

8 8

Financial Statements nancial Statements

deposits its cash in reputable financial institutions and therefore believes the risk of loss to be

Deferred revenue Inventory 25,714 8,841 8 20,780

19,896

Financial Statements

N Notes to Financial Statements

Notes to Financial Statements otes to Financial Statements

11

11

remote. The organization is exposed to credit risk from accounts receivable. The organization

Payroll source deductions 5,409 4,624 11

$

believes this credit risk is minimi $ 317,589 15 390,995

Notes to Financial Statements zed as the organization has a large and diverse customer base. A

11

2021 Canadian Underwater Conference and Exhibition

15

15

41,181

provision for impairment of accounts receivable is established when there is objective evidence that

35,008

2020 Canadian Underwater Conference and Exhibition

LIABILITIES

the organization will not be able to collect all amounts due. 15

Cover Photos: Left - CDI Barge Right - DIT Chamber

CURRENT LIABILITIES

COMMITMENTS (Note 6)

Accounts payable and accrued liabilities

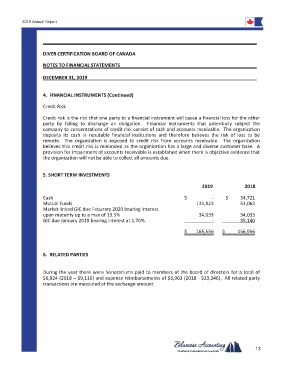

5. SHORT TERM INVESTMENTS $ 6,211 $ 10,059

NET ASSETS Deferred revenue - 25,714

4,488

Payroll source deductions 2019 2018

5,409

10,699 41,182

-

UNRESTRICTED Cash 349,814 $ 370,745 $ 34,721

Mutual Funds 131,523 53,062

Market linked GIC due Feburary 2020 bearing interest

COMMITMENTS (Note 6)

405,753

upon maturity up to a max of 13.5% $ 390,995 $ 34,033 34,033

GIC due January 2019 bearing interest at 1.70% - 35,140

NET ASSETS

$ 165,556 $ 156,956

UNRESTRICTED 306,890 349,813

Approved by the Directors:

6. RELATED PARTIES Director

$ 317,589 $ 390,995

Director

During the year there were honorariums paid to members of the board of directors for a total of

$6,924 (2018 – $9,116) and expense reimbursements of $6,963 (2018 - $23,346). All related party

transactions are measured at the exchange amount.

Approved by the Directors:

Director

Director

Director

Director

Photo courtesy of CDA-Technical Institute

2

2 2

2 13 2

8